[Poland] New PIT-2 for 2023 tailored to Polish Order 2.0

A new PIT-2 form template will come into force from 2023. It has been tailored to the provisions of Polish Order 2.0 and is expected to facilitate submitting taxpayer declarations and requests to the payer for the purposes of calculating monthly PIT advances.

PIT-2 – one form rather than several

PIT-2 version 9 will become effective from 1 January 2023. The new form includes the changes made by Polish Order 2.0 and is addressed to a wider group of taxpayers than its earlier version. It also combines several other declarations and requests into a single form, constituting a super tax form.

The new PIT-2 (9) template, under the full name PIT TAXPAYER DECLARATIONS / REQUEST for the purpose of calculating monthly personal income tax advances, can be submitted by employees (including employees with multiple jobs), contractors, persons performing work under a contract for specific tasks, members of management boards and managers on contracts.

The form combines several requests and declarations, by means of which it will be possible to submit/withdraw:

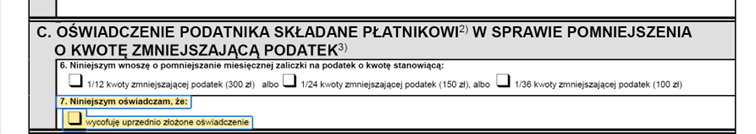

- declaration on reduction by the tax-reducing amount,

- declaration on the intention to tax income preferentially with a spouse or as a single parent,

- declaration on the right to benefit from increased employee deductible costs,

- declaration on exemptions such as the relief for families of 4+, the return relief, the relief for working seniors,

- request not to apply the young person’s relief or employee deductible costs,

- request to no longer apply the 50% tax deductible costs,

- request not to deduct advance payments for a tax year.

HR and payroll outsourcing – comprehensive service and proven solutions

New PIT-2 at any time

Under the new provisions, the PIT-2 form can be submitted at any time, not just before the payment of the first remuneration in a given year as it used to be. PIT-2 in version 9 refers to income earned as from 1 January 2023, so in theory taxpayers will be submitting the new form in 2023, but there are also no obstacles to file it earlier.

Moreover, it is important to note that there is no obligation to re-submit the declaration just because the form has been updated to a new one, this applies to situations in which there are no changes relevant to the calculation of the taxpayer’s advance payment.

However, if there are changes relevant to the calculation of advance income tax for a given taxpayer, then the taxpayer is required to submit an update declaration, i.e. PIT-2 version 9 in 2023. The form offers the option to amend or withdraw previously submitted requests or declarations.

Up to 3 payers in PIT-2

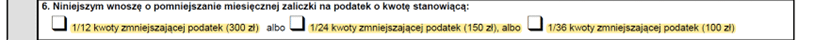

Polish Order 2.0 has changed the rules on the use of the tax-reducing amount. From 1 January 2023, a taxpayer may indicate up to 3 payers, i.e. employers, contracting parties and the Social Insurance Institution (ZUS) to reduce PIT advances by PLN 3600, whereas the tax-reducing amount will be as follows:

- one contract – PLN 300,

- two contracts – PLN 150 each,

- three contracts – PLN 100 each.

Furthermore, a PIT-2 for the purpose of reducing the advance payment by the tax-reducing amount will be available to a taxpayer who receives income from the following sources:

- employment contract,

- employment relationship

- outworking,

- cooperative employment relationship,

- contract of mandate,

- contract for specific tasks,

- contract to manage a company,

- management contract,

- property rights,

- a pension or disability pension from abroad.

HR & Payroll outsourcing – find out how we can help:

See also

Discover our services

Contract Administration Sp. z o. o.

Hrubieszowska 2

01-209 Warsaw

Poland

+48 22 295 32 00

contact@ca-staff.eu

NIP: 526-001-29-88, KRS: 0000028831,

REGON: 012548510. The District Court for the

capital city of Warsaw, XIII Commercial Division